How Much Does Cvs Charge to Load Chime Card

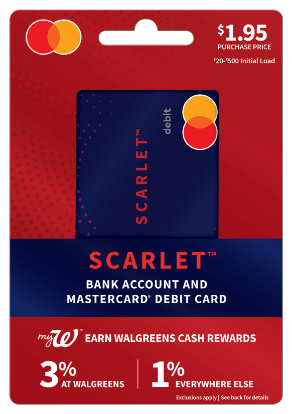

- ScarletTM Bank Account and Mastercard® Debit Card

- Green Dot Visa® Debit Cards

- GO2bank Visa® Debit Card

- Serve®

- Netspend® Visa® Prepaid Card

- PayPal Prepaid Mastercard®

What are reloadable debit cards?

Reloadable debit cards work like traditional debit cards. Customers can load funds and use to shop, transfer money, pay bills, withdraw cash from an ATM and receive direct deposits of payroll and government benefits. They can be used anywhere Visa, MasterCard or American Express cards are accepted

How to set up your

reloadable debit card

![]()

Select your card

Browse through the various reloadable debit cards available at Walgreens and decide which card is right for you.

![]()

Purchase and register your card

Visit any of our >8,000+ locations to purchase and load your card. Funds on temporary cards can be used for purchases. All cards come with instructions to register. To register your card, you will need to provide your name, address, date of birth and Social Security number. Once registered and your information is successfully veried, you will typically receive a personalized card in the mail approximately 7–10 business days.

![]()

Reload your card

Add funds to your card with direct deposit or with cash in store at any of our convenient locations.†

![]()

Use your card

Use your reloadable debit card to shop, get cash at ATMs, pay bills online or shop in stores anywhere Visa, MasterCard or American Express cards are accepted.

† Some cards require a Reload Card for adding funds. Walgreens engages in the money transmission and/or currency exchange business as an authorized delegate of GPR Card MSB's under chapter 151 of the Texas Finance Code. If you have a complaint, rst contact the consumer assistance division of Walgreens Co. at 877-865-9130, if you still have an unresolved complaint regarding the company's money transmission or currency exchange activity, please direct your complaint to: Texas Department of Banking, 2601 North Lamar Boulevard, Austin, Texas 78705, 1-877-276-5554 (toll free), www.dob.texas.gov

Find these cards

at your local Walgreens

Find store

ScarletTM Bank Account and

Mastercard® Debit Card

-

The debit card with a path to your financial health - Enjoy free ATM* withdrawals and free Bar Code Reloads† to add cash at Walgreens and Duane Reade stores

- Set Goals to help you budget money

- Pay bills anytime, anywhere with Online Bill Pay

Start earning

Walgreens Cash rewards when you use your Scarlet debit card for purchases‡

- 5% on Walgreens branded products

- 3% on all other Walgreens purchases

- 1% everywhere else Mastercard is accepted

Registration is required. Fees and limits apply. Learn more ›

* Free in-network ATM withdrawals at over 55,000 Allpoint ATMs.

† Terms and conditions apply. You can add cash at other locations for up to $3.95. For details, please visit getScarlet.com/Legal. Message and data rates may apply.

‡ Must be a myWalgreensTM member. Walgreens Cash rewards are not legal tender. No cash back. Walgreens Cash rewards good on future purchases. Exclusions apply. Complete details, including Walgreens Cash rewards expiration dates and Demand Deposit Account Rewards Terms, at getScarlet.com/Legal. ScarletTM Bank Account is a demand deposit account established by MetaBank®, National Association, Member FDIC.

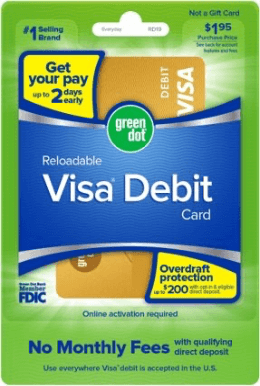

Green Dot Visa® Debit Cards

Your banking. Your choice. Green Dot has an account for you.

Green Dot Visa® Debit cards have smart everyday banking features to help you better access, budget and manage your money—anytime, anywhere you need it.

- Green Dot EveryDay Visa® Debit Card

- No monthly fees with qualifying direct deposit

- Get your pay up to 2 days early

- Overdraft protection up to $200 with opt-in & eligible direct deposit

Personalized card required. Fees and limits apply. Learn more ›

See account agreement for terms and conditions. When you direct deposit $500 or more in the previous monthly period, otherwise $7.95 per month. Direct deposit early availability depends on timing of payor's payment instructions and fraud prevention restrictions may apply. As such, the availability or timing of early direct deposit may vary from pay period to pay period. $15 fee may apply for each purchase transaction not repaid withing 24 hours of authorization of first transaction that overdraws account. Overdrafts paid at our discretion.

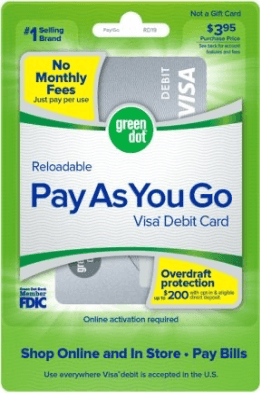

- Green Dot Pay As You Go Visa® Debit Card

- No monthly fees, just pay per transaction.

- Shop online and in stores, plus pay bills

- Overdraft protection up to $200 with opt-in & eligible direct deposit

Personalized card required. Fees and limits apply. Learn more ›

See account agreement for terms and conditions. $15 fee may apply for each purchase transaction not repaid withing 24 hours of authorization of first transaction that overdraws account. Overdrafts paid at our discretion.

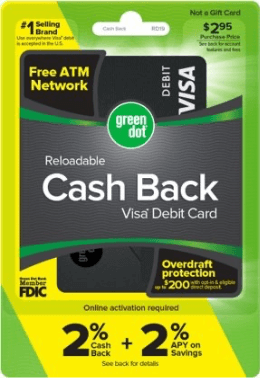

- Green Dot Cash Back Visa® Debit Card

- 2% Cash Back online and mobile purchases

- 2% APY on savings up to $10,000 balance

- Overdraft protection up to $200 with opt-in & eligible direct deposit

- Free cash reloads using the app

Personalized card required. Fees and limits apply. Learn more ›

See account agreement for terms and conditions. Cash back cannot be used for purchases or cash withdrawals until redeemed. Claim cash back every 12 months of use and your account being in good standing. 2.00% Annual Percentage Yields (APYs) are accurate as of 3/8/21 and may change before or after you open an account. $15 fee may apply for each purchase transaction not repaid withing 24 hours of authorization of first transaction that overdraws account. Overdrafts paid at our discretion.

- Two Ways to Reload Cash to Your Green Dot Card

Reload at the Register

Swipe your card at the register to immediately reload with cash. Learn more ›

Reload fees and limits apply.

MoneyPak

Send cash quickly and conveniently to almost anyone. Learn more ›

Service fee and limits apply. Must be 18 or older to use this product. Card must be activated and personalized with cardholder's name. Check card eligibility and other requirements at MoneyPak.com

GO2bank Visa® Debit Card

-

The Ultimate Mobile Bank Account - No monthly fees with qualifying direct deposit

- Get your pay up to 2 days early

- Overdraft protection up to $200 with opt-in & eligible direct deposit

- Free ATM Network—withdraw cash at thousands of free in-network ATMs nationwide

Personalized card required. Fees and limits apply. Learn more ›

See account agreement for terms and conditions.

Direct deposit early availability depends on timing of payor's payment instructions and fraud prevention restrictions may apply. As such, the availability or timing of early direct deposit may vary from pay period to pay period. $15 fee may apply for each purchase transaction not repaid within 24 hours of authorization of first transaction that overdraws account. Overdrafts paid at our discretion. $3 for out-of-network withdrawals. ATM owner may also charge a fee. ATM limits apply.

Serve®

Flexibility That Works for You

Serve is made with you in mind, with flexible options to fit your life. With a suite of options to choose from, Serve allows you to handle your money with ease. Our cards give you the freedom to spend online or in stores, the protection to safeguard your money, and the convenience of easy access:

- No credit check

- Easy registration

- Money management on the go

- Serve® American Express® Prepaid Debit Account - Serve Cash Back

Get rewarded with unlimited 1% cash back when you spend money in stores or online.1 The funds are immediately available to add to your Account, so you don't have to wait to enjoy the rewards. Earn money as you spend money.

1 With the Serve Cash Back card, earn 1% Cash Back on purchases (less returns/credits) rounded to the nearest dollar, added to your Account after you use your card. Rounding purchases to the nearest dollar means that you won't earn a fraction of a penny in Cash Back. For example, a purchase of $0.01-$0.49 rounds to $0.00 (you don't earn Cash Back), a purchase of $0.50-$0.99 rounds to $1.00 (you earn $0.01 Cash Back), and so on. Account spend limits apply. Cash Back is typically applied to your Account promptly after your purchase, but could take up to 60 days. Cash Back can be redeemed and used only for future purchases made with your card and cannot be redeemed for cash or otherwise exchanged for value. Subaccounts are not eligible to earn Cash Back. ATM transactions, fees and Serve Online Bill Pay are not purchases and do not earn Cash Back. For full terms and restrictions, see the Cash Back User Agreement at sere.com/legal.

The Serve® American Express® Prepaid Debit Account and card ("Serve Account") are issued by American Express Travel Related Services Company, Inc. licensed as a money transmitter by the New York State Department of Financial Services and other money transmitter regulators. NMLS ID# 913828. Serve Account terms, conditions and fees apply. Please see Consumer User Agreement for complete details at serve.com/legal.

Copyright © 2020 InComm Payments. All Rights Reserved. All trademarks are the property of their respective owners.

- Serve® American Express® Prepaid Debit Account – Serve Free Reloads

Whether you're looking to budget, pay bills online or manage day-to-day expenses, free reloads means you can add cash often without incurring fees. Load today, tomorrow and anytime you need at over 45,000 locations nationwide.

The Serve® American Express® Prepaid Debit Account and card ("Serve Account") are issued by American Express Travel Related Services Company, Inc. licensed as a money transmitter by the New York State Department of Financial Services and other money transmitter regulators. NMLS ID# 913828. Serve Account terms, conditions and fees apply. Please see Consumer User Agreement for complete details at serve.com/legal.

Copyright © 2020 InComm Payments. All Rights Reserved. All trademarks are the property of their respective owners.

- Serve® Pay As You Go Visa® Prepaid Card

This card gives you the freedom to spend when and where you want, on your own terms. With no hidden or monthly charges, you only pay a small fee when you make a purchase. Know what you pay and pay as you go.

Serve® Pay As You Go Visa® Prepaid Card is issued by MetaBank®, National Association, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Card may be used everywhere Visa debit cards are accepted. Serve Account terms, conditions and fees apply. Please see Cardholder Agreement for complete details at serve.com/legal

Copyright © 2020 InComm Payments. All Rights Reserved. All trademarks are the property of their respective owners.

Netspend® Visa® Prepaid Card

-

With Netspend, you get a convenient way to manage your money on a prepaid card that is packed with features! - Get paid up to 2 days faster with direct deposit2

- No minimum balance requirement

- Manage your money anywhere with our mobile app3

1 ID verification required. We will ask for your name, address, date of birth, and your government ID number. We may also ask to see your driver's license or other identifying information. Card use restrictions may apply. See netspend.com or card order page for details. Residents of Vermont are ineligible to open a card account.

2 Faster funding claim is based on a comparison of our policy of making funds available upon receipt of payment instruction versus the typical banking practice of posting funds at settlement. Fraud prevention restrictions may delay availability of funds with or without notice. Early availability of funds requires payor's support of direct deposit and is subject to the timing of payor's payment instruction.

3 Netspend does not charge for this service, but your wireless carrier may charge for messages or data. The Netspend Visa Prepaid Card is issued by MetaBank®, National Association, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Netspend is a registered agent of MetaBank, N.A. Card may be used everywhere Visa debit cards are accepted. Certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787. Use of the Card Account is subject to activation, ID verification, and funds availability. Transaction fees, terms, and conditions apply to the use and reloading of the Card Account. See the Cardholder Agreement for details.

© 2021 Netspend Corporation. All rights reserved worldwide. All other trademarks and service marks belong to their owners.

PayPal Prepaid Mastercard®

-

With a PayPal Prepaid Mastercard you can shop in store or online, wherever Debit Mastercard is accepted. - Make PayPal Transfers1 from your account at PayPal to your Card Account.

- When you enroll in Direct Deposit, you can get paid up to 2 days faster.2

- NO minimum balance requirement.

- Check your Card Account balance, see transaction history and more with our mobile app.3

- Get Anytime Alerts on account transactions.

1 PayPal Transfers require a PayPal account and a personalized card, which arrives within 10 business days after activation of your instant-issue card. If you do not already have a PayPal account you will link to this Card, visit www.paypal.com to get one, or you may get one when you activate this card online. PayPal account required for certain features, but not to have the PayPal Prepaid Card. Transfers may not exceed $300 per day/$2,000 per rolling 30 days and are limited to the funds available in your PayPal account. Transfers may only be made in the name of a valid PayPal Prepaid Mastercard Cardholder. Only one (1) PayPal Prepaid Mastercard may be linked to one (1) PayPal account. PayPal Transfers cannot be reversed or canceled. The Bancorp Bank and Mastercard are not affiliated with, and neither endorses nor sponsors the PayPal.com online account to which various funding sources, including a PayPal Prepaid Card, may be linked.

2 Faster funding claim is based on a comparison of our policy of making funds available upon receipt of payment instruction versus the typical banking practice of posting funds at settlement. Fraud prevention restrictions may delay availability of funds with or without notice. Early availability of funds requires payor's support of direct deposit and is subject to the timing of payor's payment instruction.

3 No charge for this service, but your wireless carrier may charge for messages or data.

The PayPal Prepaid Mastercard is issued by The Bancorp Bank, Member FDIC, pursuant to license by Mastercard International Incorporated. Netspend, a TSYS® Company, is an authorized representative of The Bancorp Bank. Certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787. Use of the Card Account is subject to activation, identity verification and funds availability. Transaction fees, terms, and conditions apply to the use and reloading of the Card Account. See the Cardholder Agreement for details.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

How Much Does Cvs Charge to Load Chime Card

Source: https://www.walgreens.com/topic/promotion/reloadablecards.jsp

0 Response to "How Much Does Cvs Charge to Load Chime Card"

Post a Comment